In today’s dynamic investment landscape, UK industrial property investing has emerged as a compelling opportunity for savvy investors. This guide aims to shed light on the importance of investing in this sector and provide valuable insights for those seeking to capitalize on the potential returns. Whether you are a seasoned investor or a newcomer, this guide will equip you with the knowledge to make informed decisions.

Importance of Investing in UK Industrial and Warehouse Properties

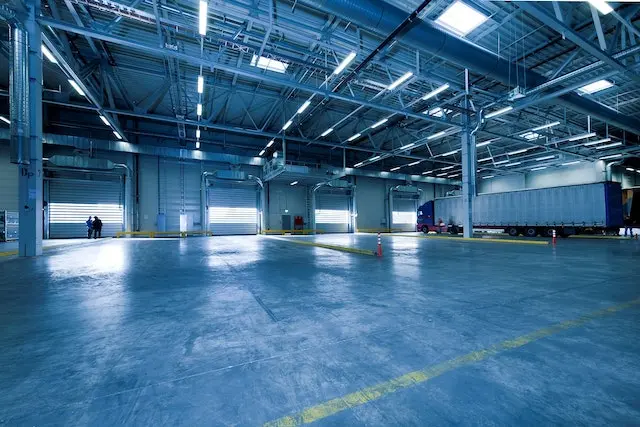

Industrial and warehouse properties play a crucial role in supporting the UK’s economy. They serve as vital hubs for logistics, manufacturing, and distribution, catering to the growing demands of e-commerce, retail, and supply chain sectors. As the market continues to evolve, investing in these properties offers numerous advantages. They provide a stable income stream, potential for capital appreciation, and diversification within a portfolio.

Overview of the Guide’s Purpose

This guide serves as a comprehensive resource, empowering investors to navigate the UK industrial and warehouse property market with confidence. For instance, it delves into key considerations for investment, financing options, due diligence, leasing strategies, and future growth opportunities. By following this guide, investors can make well-informed decisions, maximize returns, and mitigate potential risks.

Understanding the UK Industrial and Warehouse Property Market

To make sound investment decisions, it is essential to comprehend the current market trends and growth potential. This part explores the factors driving demand for industrial and warehouse properties, such as the rise of e-commerce and changes in consumer behaviour. It provides valuable insights into the various market segments and the strategic importance of location analysis.

Key Considerations for Investing in UK Industrial and Warehouse Properties

Successful investing requires careful evaluation of property types, rental income potential, and associated risks. In this part we highlight the importance of assessing market trends, rental yields, and conducting comprehensive risk analysis. It guides investors in making strategic decisions about property selection and positioning to maximize returns.

Financing Options and Investment Strategies

Investment opportunities in industrial and warehouse properties can be capitalized on through various financing options. This section explores sources of funding, such as commercial mortgages and partnerships, and provides investment strategies tailored to different risk profiles. It also highlights the potential tax incentives and benefits available for investors.

Due Diligence and Property Valuation

Before committing to an investment, thorough due diligence is essential. Furthermore, we outline the crucial steps involved in conducting comprehensive property inspections, surveys, and market analysis. It also explores property valuation methods, ensuring investors can accurately assess the potential value and returns of their investments.

Leasing and Property Management

Once the investment is secured, effective leasing and property management strategies are crucial for success. This section provides guidance on attracting and retaining tenants, understanding legal requirements, and negotiating lease agreements. It also emphasizes the importance of proactive property management to maintain tenant satisfaction and preserve the value of the investment.

Exit Strategies and Future Growth

Investors should always plan for the future and have exit strategies in place. This part discusses various options for exiting industrial and warehouse property investments, including selling, refinancing, or portfolio expansion. In summary, it also encourages investors to stay informed about market trends and seize opportunities for future growth.

Understanding the UK Industrial and Warehouse Property Market: Unlocking Growth Potential

The UK industrial and warehouse property market is a thriving sector, offering lucrative investment opportunities for astute investors. This part of our guide aims to provide an in-depth understanding of the current market trends and the factors driving the demand for industrial and warehouse properties in the UK.

Current Market Trends and Growth Potential

The UK industrial and warehouse property market is experiencing robust growth, driven by several key trends. The rise of e-commerce has significantly increased the need for efficient logistics and distribution centers. Furthermore, the shift in consumer behaviour towards online shopping has created a surge in demand for last-mile delivery facilities strategically located near urban areas. This trend is expected to continue, fuelled by the convenience-seeking habits of consumers.

Factors Driving Demand for Industrial and Warehouse Properties

Several factors contribute to the growing demand for industrial and warehouse properties in the UK. Firstly, the evolution of supply chain management necessitates larger and more technologically advanced facilities to accommodate increased inventory levels and handle automated processes. Secondly, the growth of the manufacturing sector, particularly in industries such as pharmaceuticals and technology, requires purpose-built facilities to support their operations. Thirdly, the rise of third-party logistics providers and outsourcing of supply chain activities has led to increased demand for flexible and well-located warehouse spaces.

Additionally, understanding these market trends and demand drivers is crucial for investors looking to capitalize on the growth potential of the UK industrial and warehouse property market. By aligning investment decisions with these trends and factors, investors can position themselves strategically and maximize their returns.

In the next section of our guide, we will delve into the key considerations for investing in UK industrial and warehouse properties. We will explore location analysis, property types, rental income potential, and risk assessment. By understanding these crucial aspects, investors can make informed decisions and unlock the full potential of their investments in this thriving market.

Key Considerations for Investing in UK Industrial and Warehouse Properties: A Comprehensive Guide

Investing in UK industrial and warehouse properties can offer significant returns for investors. In this part of our guide, we will explore the key considerations that can enhance investment success. For example, from location analysis and property assessment to evaluating rental income potential and mitigating risks, understanding these factors is vital for making informed investment decisions.

Location Analysis and Strategic Positioning

Location plays a pivotal role in the success of industrial and warehouse property investments. Furthermore, conducting a thorough location analysis is essential to identify areas with high demand, proximity to transportation networks, and access to target markets. Moreover, strategic positioning near major ports, airports, or distribution hubs can enhance rental demand and potential returns.

Assessing Property Types and Market Segments

Understanding property types and market segments is crucial for targeting the right investment opportunities. Industrial properties range from distribution centres to manufacturing facilities, each with its own unique considerations. All in all, by identifying the specific market segment that aligns with investment goals, investors can focus on properties that meet their criteria and maximize potential returns.

Evaluating Rental Income Potential and Yields

Evaluating rental income potential is a vital aspect of investment analysis. Factors such as current rental rates, demand-supply dynamics, and lease terms should be carefully assessed. Calculating rental yields, such as gross and net yields, helps investors gauge the income-generating capacity of the property and make informed investment decisions.

Identifying Potential Risks and Mitigating Strategies

Investments come with inherent risks, and understanding and mitigating these risks is crucial. Factors such as economic volatility, tenant vacancy, and changes in market dynamics can impact investment performance. Identifying and implementing appropriate risk mitigation strategies, such as diversification, securing long-term leases, and conducting thorough due diligence, can help safeguard investments against potential setbacks.

By considering these key factors, investors can make well-informed decisions when investing in UK industrial and warehouse properties. The next section of our guide will explore financing options and investment strategies, providing valuable insights into funding sources, risk management, and maximizing returns.

Financing Options and Investment Strategies for UK Industrial and Warehouse Properties

In this section of our guide, we will delve into the crucial aspects of financing and investment strategies for UK industrial and warehouse properties. For example, understanding the available financing sources, tailoring investment strategies to different risk profiles, and leveraging tax incentives are essential for maximizing returns and mitigating potential risks.

Financing Sources for Industrial and Warehouse Property Investments

Obtaining appropriate financing is crucial for acquiring industrial and warehouse properties. Investors can explore options such as commercial mortgages, loans from financial institutions, or partnerships with private investors. Conducting thorough research, comparing interest rates, and assessing repayment terms are essential steps in securing suitable financing.

Investment Strategies for Different Risk Profiles

Investment strategies should align with an investor’s risk profile and objectives. For risk-averse investors, a conservative approach focusing on stable income generation and long-term appreciation may be suitable. On the other hand, risk-tolerant investors may opt for a growth-oriented strategy, targeting emerging market segments or properties with potential for redevelopment or expansion.

Leveraging Tax Incentives and Benefits for UK Industrial Property Investing

Understanding and utilizing tax incentives and benefits can significantly enhance investment returns. The UK offers various tax reliefs and allowances for industrial and warehouse property investments. In summary, investors can explore capital allowances, business rates relief, and other tax benefits to optimize their financial position.

By carefully considering financing options, tailoring investment strategies to risk profiles, and leveraging tax incentives, investors can navigate the UK industrial and warehouse property market with confidence. The next section of our guide will focus on due diligence and property valuation, providing insights into conducting comprehensive assessments and accurately evaluating investment opportunities.

Due Diligence and Property Valuation: Ensuring Successful Investments in UK Industrial and Warehouse Properties

In this section of our guide, we will explore the critical aspects of due diligence and property valuation when investing in UK industrial and warehouse properties.

Conducting thorough due diligence, assessing property valuation methods, and engaging professional services are essential steps. They help make informed investment decisions and mitigate potential risks.

Conducting Thorough Due Diligence on Potential Investments in UK Industrial Property Investing

Before committing to an investment, conducting comprehensive due diligence is vital. This involves analysing the property’s legal status, financial records, and any potential liabilities. It also includes assessing the property’s suitability for the intended use, examining zoning and planning regulations, and evaluating potential environmental risks.

Assessing Property Valuation Methods and Factors

Accurate property valuation is crucial for determining the fair market value and potential returns on investment. Various valuation methods, such as the income approach, sales comparison approach, and cost approach, can be employed. Factors such as location, market demand, property condition, and rental income potential should be considered in the valuation process.

Engaging Professional Services for Property Inspections and Surveys in UK Industrial Property Investing

Additionally, engaging professional services for property inspections and surveys adds an additional layer of assurance. Professional surveyors can identify potential structural issues, assess the condition of the property, and provide expert advice. Environmental surveys can help uncover any environmental contamination or hazards, enabling investors to make informed decisions.

By conducting thorough due diligence, employing proper property valuation methods, and engaging professional services, investors can make informed decisions in the UK industrial and warehouse property market.

The next section of our guide will focus on leasing and property management. It will provide insights into effective strategies for attracting and retaining tenants and ensuring successful property management.

Leasing and Property Management: Maximizing Returns in UK Industrial and Warehouse Properties

In this section of our guide, we will explore the essential aspects of leasing and property management in UK industrial and warehouse properties. additionally, effective leasing strategies, understanding legal requirements and lease agreements, and implementing robust property management practices are vital for attracting tenants, maximizing occupancy rates, and ensuring the long-term success of investments.

Leasing Strategies for Attracting and Retaining Tenants in UK Industrial Property Investing

Implementing effective leasing strategies is crucial for attracting and retaining tenants. In fact, this involves understanding the target market, promoting the property through various channels, and showcasing its unique features and benefits. Offering flexible lease terms, tenant incentives, and exceptional customer service can also help attract and retain high-quality tenants.

Understanding Legal Requirements and Lease Agreements

Comprehending the legal requirements and intricacies of lease agreements is essential for both landlords and tenants. In fact, understanding rights and responsibilities, rent reviews, repair and maintenance obligations, and termination clauses is crucial. Engaging legal professionals to draft and review lease agreements can help ensure compliance and protect the interests of all parties involved.

Effective Property Management Practices in UK Industrial Property Investing

Implementing effective property management practices is vital for maintaining tenant satisfaction and preserving the value of the investment. For example, this includes regular property inspections, prompt response to maintenance issues, effective communication with tenants, and proactive management of lease renewals and rent collections. Consequently, building strong relationships with tenants and addressing their needs promptly can foster long-term tenant retention.

By employing strategic leasing strategies, understanding legal requirements, and implementing effective property management practices, investors can optimize the performance of their UK industrial and warehouse properties.

The next section of our guide will focus on exit strategies and future growth opportunities. It will provide insights into potential exit options, capitalizing on market trends, and strategies for portfolio expansion and diversification.

Exit Strategies and Future Growth: Navigating the UK Industrial and Warehouse Property Market

In this section of our guide, we will explore the importance of developing exit strategies and planning for future growth in UK industrial and warehouse property investments. Furthermore, identifying potential exit options and timing, capitalizing on market trends and demand, and implementing strategies for portfolio expansion and diversification are key considerations for maximizing returns and ensuring long-term success.

Identifying Potential Exit Options and Timing in UK Industrial Property Investing

Having a clear understanding of potential exit options is crucial for investors. These options may include selling the property, refinancing, or transitioning to a different asset class. Consequently, assessing market conditions, economic factors, and the investor’s financial goals can help determine the most opportune time to execute the exit strategy.

Capitalizing on Market Trends and Demand

Staying informed about market trends and demand is essential for identifying growth opportunities. Understanding emerging market segments, technological advancements, and changing consumer preferences can guide investors in making strategic decisions. Adapting to market dynamics and capitalizing on evolving trends can lead to enhanced returns and future growth.

Strategies for Portfolio Expansion and Diversification in UK Industrial Property Investing

Strategic portfolio expansion and diversification can contribute to long-term growth and risk mitigation. For instance, this may involve acquiring properties in different geographical areas, exploring new market sectors, or investing in related asset classes. A well-diversified portfolio can help investors capitalize on various opportunities and protect against volatility in specific sectors.

By identifying potential exit options and timing, capitalizing on market trends and demand, and implementing strategies for portfolio expansion and diversification, investors can navigate the UK industrial and warehouse property market with confidence. In the concluding section of our guide, we will summarize key points and offer recommendations to empower investors to take action and seek professional advice in their investment journey.

Conclusion

In this concluding section of our guide, we recap the key points and recommendations to empower investors to make informed decisions when investing in UK industrial and warehouse properties. We also encourage taking action and seeking professional advice to maximize the potential of these investments.

Recap of Key Points and Recommendations for UK Industrial Property Investing

Throughout this guide, we emphasized the significance of understanding the UK industrial and warehouse property market. We highlighted conducting thorough due diligence, evaluating financing options, implementing effective leasing and property management strategies, and planning for future growth. Key recommendations include:

- Stay informed about current market trends and growth potential.

- Conduct thorough due diligence on potential investments, assessing location, property types, and risks.

- Explore financing options and select investment strategies that align with your risk profile.

- Leverage tax incentives and benefits to optimize financial positions.

- Implement effective leasing strategies and prioritize tenant satisfaction.

- Understand legal requirements and lease agreements to ensure compliance.

- Practice effective property management to preserve value and maintain tenant relationships.

- Identify potential exit options and timing, capitalizing on market trends and demand.

- Consider portfolio expansion and diversification for long-term growth and risk mitigation.

Encouragement to Take Action and Seek Professional Advice in UK Industrial Property Investing

Investing in UK industrial and warehouse properties offers exciting opportunities for growth and financial success. As you start your investment journey, it’s crucial to take action and implement the strategies and recommendations from this guide. Additionally, seeking advice from property advisors, legal professionals, and financial experts is valuable. They can offer tailored insights to help you achieve your investment goals.

By combining your investment passion with the knowledge gained from this guide, and with the support of industry professionals, you can navigate the market complexities confidently. This will enable you to unlock the full potential of UK industrial and warehouse property investments.

Remember, the key to success lies in taking action, staying informed, and seeking expert guidance. All in all, start your journey today and embrace the opportunities that await in the UK industrial and warehouse property market.

Explore our current investment opportunities and maximize returns with Red Cardinal’s expertly curated prospects across the country.